The maritime industry stands at the forefront of global trade, playing a pivotal role in connecting markets and fostering economic growth. Yet despite being a highly efficient form of transporting goods, shipping is also responsible for roughly 3% of global carbon emissions. If the maritime industry were a country, it would rank among the top ten emitters worldwide a stark reality that underscores an urgent need for improvement to support global decarbonization efforts.

On the positive side, for an industry that has long been perceived as an environmental laggard, 2023 marked a turning point. Key developments that will help enable decarbonization included:

- Enhanced Regulatory Frameworks. The tightening of regulations by both the International Maritime Organization (IMO) and the EU have deepened the decarbonization conversation.

- Technological Innovations. Breakthroughs on both engine designs and efficiency-enhancing mechanisms are redefining the energy efficiency potential of shipping.

- Higher Availability of Alternative Fuels. The increased availability of biofuels and other clean fuels in ports worldwide is expanding fuel choices, although still not at the scale needed.

- Corporate Commitment and Action. A rise in corporate commitment, demonstrated by the growing number of dual-fuel orders, reflects a more robust push toward environmental responsibility.

In BCG’s third annual Shipping Decarbonization Survey—a study aimed at assessing the readiness of shipping customers to pay a premium for green transportation methods—we engaged 125 decision makers in 2023. These survey participants included heads of logistics, supply-chain directors, and other executives who determine cargo owners’ choices of maritime providers. Among our principal findings is that the shipping industry is still struggling to convert commitments into measurable actions.

How can carriers speed up this process in the overall drive toward net zero? Although the barriers to progress are high, we see clear navigational paths that can overcome them.

The Problem: Momentum Is Growing, but Barriers Remain

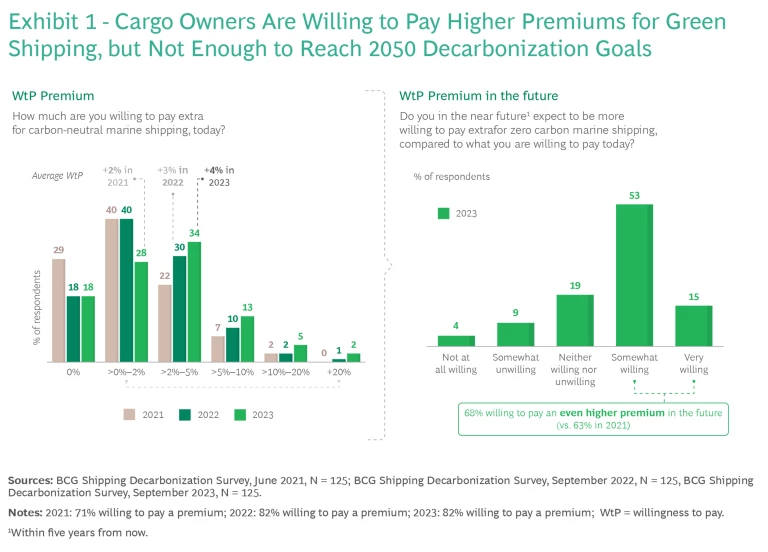

Green shipping is broadly gaining momentum, with significant developments in both the public and private sectors. The same can be said for related technologies and the development of alternative fuels. Our 2023 survey showed that more than 80% of shipping customers are prepared to pay a premium for green shipping, with the average premium currently at 4%—an increase of 33% from 2022 and double the rate of 2021. (See Exhibit 1.) Nonetheless, the projected growth rates still fall short of the levels required for significant decarbonization.

According to a study coproduced by BCG and the Global Financial Markets Association (GFMA) , a premium of 10% to 15% will be necessary to achieve complete decarbonization of the shipping sector by 2050. In the shorter term, the premium might need to be as high as 30% to 40% before the production of alternative fuels can be scaled up effectively. As of now, only a select group of companies is willing to pay a premium exceeding 10%.

Overall, we have identified three major barriers that continue to impede the progress of green shipping.

Subscale Alternative-Fuel Production. A 2023 BCG study coproduced with the World Economic Forum (WEF) indicated a rising demand for alternative fuels, as demonstrated by the order of more than 180 dual-fuel ships. However, over 95% of projects focused on producing these fuels are still in the pre-final investment decision (FID) stage. The study outlines 10 key challenges to scaling up the zero-emission fuel supply, including issues related to macroeconomics, regulation, supply chains , and organizational structures.

Shifting Regulatory Requirements. Although 2023 witnessed significant regulatory actions by the IMO and the EU, the regulatory landscape remains in flux particularly regarding vital decisions on fuel standards and the size and timing of a potential carbon tax. Such shifting regulation can prompt companies to stay on guard and remain hesitant to invest rapidly and confidently in green shipping.

A Budget Gap Among Cargo Owners. Although more than 60% of our survey respondents have committed to reducing Scope 3 shipping emissions—those for which a carrier is indirectly responsible throughout its value chain but does not generate itself—less than half report having an adequate budget to achieve their targets. Clearly, the gap between admirable ambitions and required financial resources is still fairly wide.

The Solution: Search Out Growth Areas and Take Action

The present state of the maritime industry calls for a shift from mere promises to tangible investments in green initiatives. The key enabling developments are robust, and commitments from both public and private sectors are in place. The real challenge lies in converting these commitments into concrete actions. In this crucial phase, the cargo carriers cannot wait for optimal regulations to take shape or for customers to take the lead. They must proactively identify and seize opportunities for growth in green shipping. There are two principal imperatives.

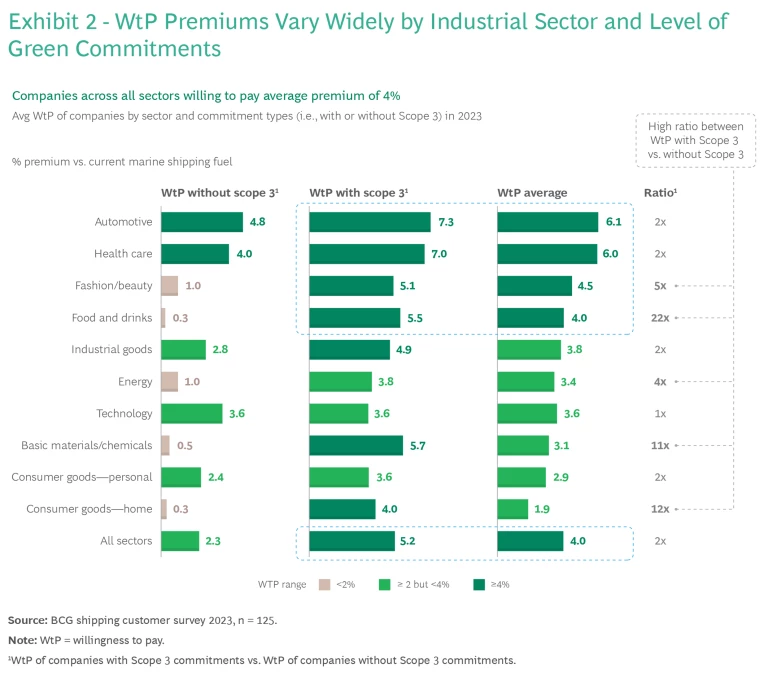

Capture untapped segments. We believe that untapped pockets of growth in the market can finance the development of a viable and sustainable green shipping product. But carriers must first identify prospects that are willing to invest in carbon-neutral transportation. Overall, current WtP premiums vary widely both by industrial sector and level of green commitments. (See Exhibit 2.)

Our survey has revealed several promising segments:

- Customers with Scope 3 Commitments. Roughly 60% of respondents have Scope 3 commitments, showing an average WtP premium of 5.2%, compared with 2.3% among those without commitments.

- Customers That See Regulation as an Opportunity. About 40% of respondents view tightening regulations as an opportunity and are willing to pay a 6% premium for green shipping (compared with 3.5% among those who see regulations as a threat). There is thus a significant opening for cargo carriers to collaborate with these forward-thinking customers. Notably, in the basic materials sector, customers that are committed to Scope 3 emissions targets show a WtP premium of 5.7%, compared with only 0.5% among those without such commitments.

- Industry-Specific Customers. The automotive and health care industries exhibit the highest WtP premiums, at 6.1% and 6.0%, respectively.

- Region-Specific Customers. Europe leads with a WtP premium of 5.1%, significantly higher than North America, at 3.3%, and South America, at just 1%.

- Combined Customer Groups. When combining specific groups, such as European food and drinks customers with Scope 3 targets, the average willingness to pay reaches a premium of 11.3%—a level closer to that truly needed to decarbonize the shipping industry.

Be an early mover. The unexploited commercial opportunities in green shipping are fundamentally the result of a gap in market offerings and customer needs. Despite a clear willingness among many cargo owners—especially those with Scope 3 commitments—to pay a premium for green shipping, they often face limited access to such options. Our survey revealed that only about 35% of customers have been presented with green shipping options, with the percentage slightly higher (at around 40%) for those with Scope 3 commitments.

This disconnect may stem from two primary issues. First, shipping companies currently providing green transportation might not be effectively segmenting their target market, or they may lack a robust go-to-market strategy. Second, companies not yet offering green options may be unaware of the existing demand from their customers, causing them to miss out on substantial business development potential.

Companies not yet offering green options may be unaware of the existing demand from their customers, causing them to miss out on substantial business development potential.

Such a scenario presents a lucrative chance to capture market share for early movers. By developing a strong go-to-market strategy that clearly identifies and serves customers that are ready to invest in green shipping, cargo carriers can secure a sizable competitive advantage. At the same time, they can help drive the industry’s progress toward sustainability. This type of proactive approach is critical to the quest for a greener and more sustainable maritime future.

Strategic Recommendations for Carriers

At this pivotal moment in the maritime industry’s shift toward sustainability, it’s mandatory for shipping companies to successfully develop and market green products. Based on the overall BCG framework for successfully navigating climate change and sustainability issues , we see a number of imperatives for shippers.

Develop a holistic go-to-market strategy for green shipping. To effectively launch green shipping products, carriers need a comprehensive, strategic approach that goes beyond merely creating an operational product. They must also align their offerings with market demands and customer needs. Key aspects of this strategy include the following:

- Target Segmentation. Identifying and focusing on customer segments that are willing to pay a premium for green shipping is critical. Forging an effective strategy that includes evaluating various segments for business potential, engaging early adopters, and exploring customer partnerships to co-invest and codevelop products will help carriers tailor their offerings.

- Pricing Strategy. A nuanced pricing strategy is essential to scaling green products successfully—starting with early adopters that are most willing to pay a premium and progressively targeting mainstream buyers. Such a domino strategy should be shaped based on the unique characteristics and needs of each customer segment.

- Sales Channel Development. Given the growing trend among cargo owners toward digital purchasing, it’s important to establish diverse sales channels that include digital platforms. This approach not only aligns with evolving purchasing behaviors but also ensures greater transparency on emissions and costs, a characteristic that is increasingly valued by customers.

Collaborate across the value chain. The 2023 BCG/WEF report highlights the substantial benefits of collaboration between fuel producers and their customers to develop a green-fuel value chain. This partnering approach significantly reduces risks and facilitates the launch of large-scale fuel projects, as evidenced by the benefits below:

Collaboration between fuel producers and their customers to develop a green-fuel value chain reduces risks and facilitates the launch of large-scale fuel projects.

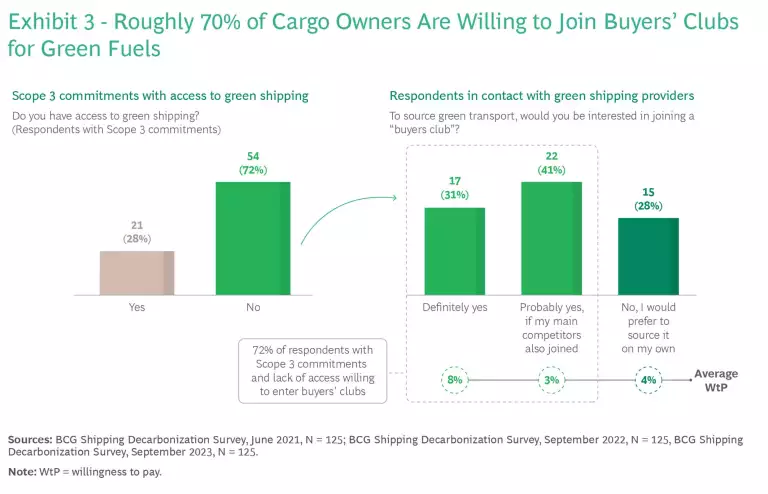

- Pooling Expertise and Sharing Risks. Collaboration is instrumental in combining expertise, sharing risks, and managing costs, thereby driving demand for green transportation. About 70% of cargo owners indicate a willingness to join buyers’ clubs for green fuels, with 31% definitely willing and 41% considering it (particularly if their competitors also participate). (See Exhibit 3.) Such clubs are especially advantageous for smaller customers with contractual limitations, as these groups help secure long-term offtake agreements (which bind counterparties to buy or sell fuel in the future). The creation of the Zero Emission Maritime Buyers Alliance, a coalition established to fast-track commercial deployment of zero-emission shipping, highlights the power of bundling demand to spur supply.

- Cost Sharing. Spreading out costs among industry participants is also important, particularly as initial green shipping projects are likely to be more expensive until economies of scale and learning curves reduce the required spending. Sharing costs both with customers and fuel producers makes it more feasible for shippers to commit to green initiatives. A prime example is the partnership between Amazon, Inditex, and Maersk that utilizes Maersk’s ECO Delivery ocean logistics service.

- New Funding Mechanisms. The BCG/WEF report also highlights the need for alternative funding mechanisms to mitigate offtake risks. The current gap in appropriate financing options can be bridged by innovative financial structures such as minimum revenue or capacity payments, dynamic contract pricing, and equity stakes for strategic buyers. Such methods, coupled with a mix of senior and junior debt, special-purpose vehicles, and government incentives, can provide the necessary financial backing.

- Transparency. Approximately 40% of stakeholders see the lack of traceability and trust in emissions reductions as a major investment barrier in green shipping. Transparency in emissions and costs is crucial to strengthening market confidence and upholding commitments to green practices.

Proactively take key transformational steps. Thoroughly preparing an organization for transformation is vital to success. The key elements for readiness involve these action steps:

- Enable leadership excellence. Shippers need to enable leadership in spearheading change, emphasizing skills development, and aligning incentives. Building a culture that is supportive of sustainability objectives is crucial for long-term viability.

- Optimize organizational structure and human resources. Securing the necessary talent and establishing accountable governance structures are table stakes for true transformation. Defining clear KPIs and targets, along with rigorous progress tracking, will facilitate effective implementation.

- Drive digital capabilities. Carriers need to develop a comprehensive digital infrastructure that enhances transparency and provides clear insights into the organization’s emissions. This step is pivotal to establishing productive management and accurate reporting on sustainability efforts.

- Align financial incentives. Financial strategies should be in harmony with the company’s sustainability goals. Implementing mechanisms such as internal carbon taxes and focusing on sustainable capital management are effective ways to reinforce commitment to green objectives.

- Sharpen marketing and communication. Companies should adopt robust communication strategies, both internally to align the workforce with sustainability goals and externally to publicly position the company as a leader in green initiatives. Clear and user-friendly communication enhances reputational value and supports market positioning.

By following these strategic recommendations, carriers can not only champion the cause of green shipping but also leverage it as a significant business opportunity—one that contributes to a sustainable future and positions cargo carriers as leaders in the green transformation of the maritime industry.

The maritime industry stands at a key juncture. It is facing the dual challenges of taking on environmental responsibility and seizing the business opportunities presented by green shipping. This inflection point demands strong leadership and a collaborative spirit among customers seeking green solutions and companies that are capable of delivering them.

For cargo carriers, the current moment offers a unique chance to lead the way in sustainability. By developing and marketing green transportation products, backed by effective go-to-market strategies, they can significantly contribute to a more sustainable future.

Long-term success will not come easily, of course. It calls for bold, early-mover leadership. But by acting decisively, shipping pacesetters can make great progress in steering their own industry and the greater business community toward a truly net-zero future.